Fascination About Pvm Accounting

Fascination About Pvm Accounting

Blog Article

Examine This Report on Pvm Accounting

Table of ContentsHow Pvm Accounting can Save You Time, Stress, and Money.Getting My Pvm Accounting To WorkTop Guidelines Of Pvm AccountingA Biased View of Pvm AccountingHow Pvm Accounting can Save You Time, Stress, and Money.Everything about Pvm Accounting4 Easy Facts About Pvm Accounting DescribedExcitement About Pvm AccountingThe Single Strategy To Use For Pvm AccountingPvm Accounting for Dummies

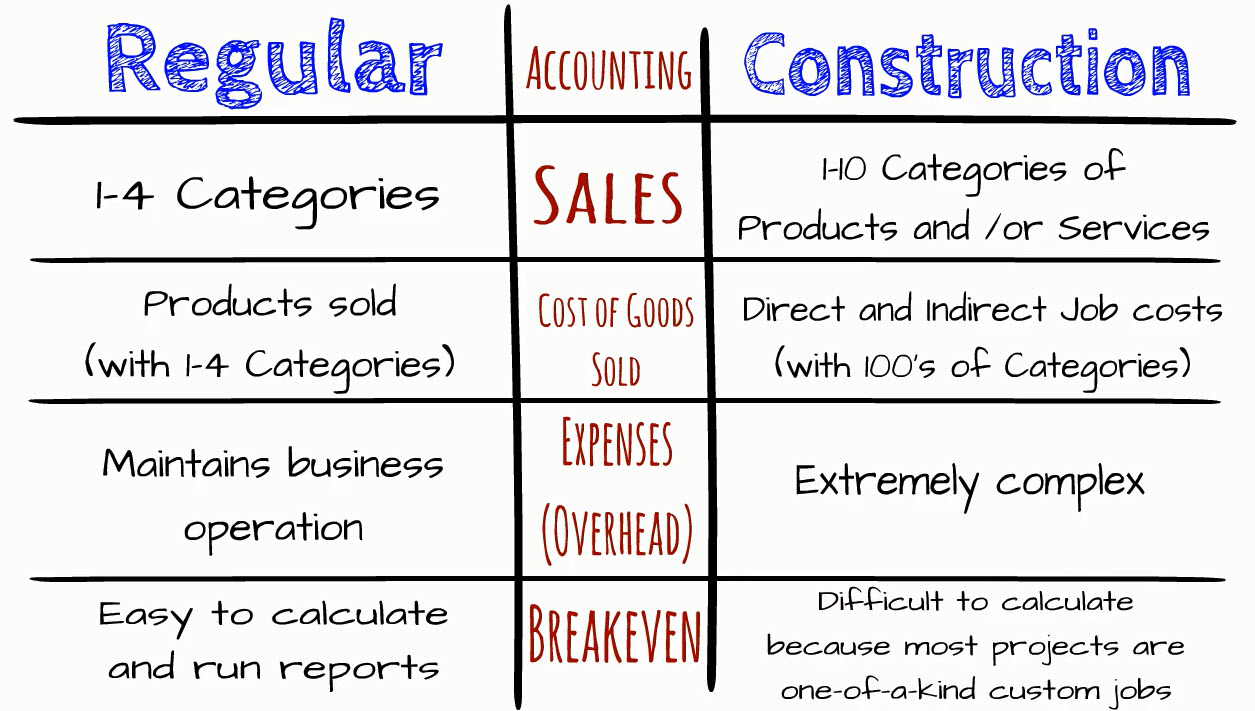

From rising and fall market demands to the detailed dance of handling task budgets, the difficulties are many. Our experience as a committed building accounting professional for numerous firms has actually equipped us with a vital perspective on these complexities. As an audit company focusing on this market, we are adept at identifying options that guard a company's monetary health and wellness.Our treatment as building and construction accountants develops a framework for financial stability in businesses that deal with unpredictable financial cycles. We take on the complexities of project-based bookkeeping head-on, turning prospective economic pitfalls into chances for growth and earnings. Being a keystone for building and construction organizations, we browse the intricacies of tax planning, compliance, and financial management with accuracy.

Not known Details About Pvm Accounting

Component of clawing the method out of the workstation and into the executive meetings requires the right individual (construction taxes). https://leonelcenteno.wixsite.com/pvmaccount1ng/post/unlocking-the-secrets-of-construction-accounting. Despite having an armful of methods and a future loaded with intense possibilities, people who function in the financial world are conditioned to play it safe. Finding team members with the understanding called for and visibility to alter is the secret sauce

The Definitive Guide for Pvm Accounting

Otherwise, it matters not if they exist, their opinions and understandings may not land. One of one of the most essential aspects of being taken seriously at a round table with building and construction executives is to talk the language. According to Jamie Tancos of Forvis, "You have to talk their languagethey don't intend to chat debits and credit scores.

Gaining the experience to conquer this disconnect doesn't have actually to be complicated. Get hold of a hard hat and some boots and head to the task website.

Pvm Accounting - Questions

Task accountants are the unhonored heroes of the service globe. They work relentlessly behind the scenes to maintain jobs on track and within budget.

Task accountants are specialized accountants with training in building and construction jobs. Project accounting professionals take care of all things monetary when it comes to building tasks.

The Pvm Accounting PDFs

One of the most vital tasks of a project accounting professional is economic coverage. Stakeholders make use of these reports to track development and make educated decisions. Job accounting professionals additionally utilize economic statements to determine prospective troubles and methods. Task accounting professionals assign and manage task budgets. They prepare normal financial records on the task.

Task accounting professionals must track & assess task expenses. Project accounting professionals work with supervisors and make sure tasks adhere to required regulations and policies.

Pvm Accounting - The Facts

Orientation with these tasks aids project accounting over at this website professionals recognize what good funds look like. Project accounting professionals handle the billing procedure. Project accountants might also manage accounts receivable.

If you're a building and construction company owner, it's essential to comprehend the details pay-roll needs for the construction industry. This will help ensure you abide with all labor laws and avoid penalties for non-compliance.

There are likewise several additional benefit that building and construction workers are entitled to, consisting of health insurance, getaway pay and retirement benefits. Some benefits are taxed and others are not. Along with wages, this information is reported on W-2s and 1099s for your staff members and subcontractors at the end of the year.

Not known Details About Pvm Accounting

For building and construction firms, it is very important to comprehend the need for the locations where you have continuous jobs. Remaining up to day on this will certainly ensure you are paying your staff members what they are qualified to while preserving conformity with all labor legislations. When it concerns, there are various other policies and reductions you need to keep an eye out for.

"In building, payroll demands aren't just paperwork; they're the nuts and screws that hold the industry with each other - Clean-up bookkeeping. Understanding these one-of-a-kind needs guarantees a strong groundwork for success in the area." John Meibers, VP & GM, Deltek ComputerEase

The Basic Principles Of Pvm Accounting

Handle the preparation of month-to-month billing plans for all billable tasks, consisting of all applicable backup. Guarantee a smooth money circulation by bookkeeping, creating, and sending out billings without delay.

Orientation with these tasks assists project accountants recognize what good financial resources look like. Job accountants take care of the invoice process. Task accountants may additionally manage accounts receivable.

What Does Pvm Accounting Do?

There are also lots of additional benefit that building and construction workers are qualified to, including wellness insurance coverage, getaway pay and retired life benefits. Some advantages are taxed and others are not. Together with wages, this info is reported on W-2s and 1099s for your employees and subcontractors at the end of the year.

For construction firms, it is necessary to recognize the demand for the areas where you have ongoing work. Remaining up to date on this will guarantee you are paying your workers what they are entitled to while keeping conformity with all labor laws. When it comes to, there are various other policies and reductions you need to look out for.

"In building and construction, pay-roll requirements aren't simply documents; they're the nuts and bolts that hold the sector together - construction taxes. Understanding these one-of-a-kind demands ensures a strong groundwork for success in the area." John Meibers, VP & GM, Deltek ComputerEase

The smart Trick of Pvm Accounting That Nobody is Talking About

Take care of the prep work of month-to-month invoice packages for all billable projects, including all suitable back-up. Make certain a smooth cash flow by auditing, generating, and sending invoices immediately.

Report this page